and eliminated, the pipelines can remain in operation for a long

time.

When it comes to gas trunk pipelines, the situation with

the length of their period of use is similar. However, it is rapidly

changing (Table 4).

Both Transneft and Gazprom have developed

programmes for upgrading pipelines and are now

implementing them. In 2010, the ‘Programme for Technical

Re-Equipment, Complete Overhaul and Reconstruction and

Development of JSC Transneft Oil Trunk Pipelines Facilities

for 2011 - 2017’ was formed and approved. The programme

includes replacement of a total of 6503.61 km of pipelines

before 2017 (i.e. more than 10% of the

total length of pipelines operated by

the company). All sections of trunk

pipelines that have been in operation

for over 30 years have been examined.

Based on these studies, the remaining

safe operation period of the pipelines has

been calculated.

7

Gazprom is also implementing

comprehensive programmes for repair,

complete overhaul and technical

re-equipment of gas transmission facilities

(Table 5).

However, overhauls and technical

re-equipment require major capital

investment and new technologies. Ever

since anti-Russian sanctions have been

imposed, access to advanced technologies

and foreign credit markets has been

hindered. Therefore, import substitution has become a practical

task rather than a hypothetical question.

In the past

This is not the first time that the oil and gas industry is dealing

with this task. In November of 1962, NATO approved an

embargo on the supply of large diameter pipes that were in

demand for the construction of pipelines in USSR. When the

Federal Republic of Germany sharply limited the supply of pipes

that were necessary for the construction of trunk pipelines,

an electric-weld pipe workshop (EWPW-2) was built at the

Khartsyzsk Pipe Plant (Ukraine) and its products substituted

those of Germany. The Khartsyzsk Pipe

Plant was the only plant in USSR that

manufactured large diameter pipes.

On 29 December 1981, US President

Ronald Reagan announced trade sanctions

against the USSR, including terminating

the supply of materials intended for the

construction of the Siberian gas pipeline.

The sanctions included foreign companies

that supplied technology and equipment

to USSR and operated in the US market.

Margaret Thatcher, then Prime Minister

of Great Britain, managed to secure that

the rules for control of product re-export

did not apply to any British companies.

These companies, along with companies

from other capitalist countries, supplied

pipes, gas turbines and other equipment

for the construction of the Urengoy-

Pomary-Uzhgorod pipeline that connected

Western Siberia and Europe.

In the 1990s, the production of large diameter pipes virtually

stopped in Russia. However, today it is actively developing

and modernising. In 2005, the Vyksa metallurgical plant started

manufacturing large diameter pipes. This included a line for

manufacturing of pipes with a single straight seam for oil and

gas trunk pipelines that have a diameter of up to 1420 mm

and wall thickness of up to 48 mm. Currently, large diameter

pipes are being manufactured at the Izhora Pipe Mill, the

Volzhsky Pipe Plant, the Chelyabinsk Pipe-Rolling Plant and the

Cherepovets Pipe-Rolling Plant. Their production is enough to

meet the needs not only of Russian consumers, but of foreign

consumers as well.

Acquiring equipment

When it comes to provision of large diameter pipes to new

construction projects’ sites (such as the Power of Siberia)

there are also no problems. Neither were there any obstacles

when the projects ESPO-1 (the pipeline from Taishet in Irkutsk

Oblast to Skovorodino Amur Oblast) and ESPO-2 (the pipeline

from Skovorodino to the Far East port Kozmino) were being

implemented.

However, the anti-Russian sanctions imposed in 2014 had

a negative impact on technical equipment provision to the

industries that determine the competitive position of Russia

in energy markets, including the pipeline transport industry. A

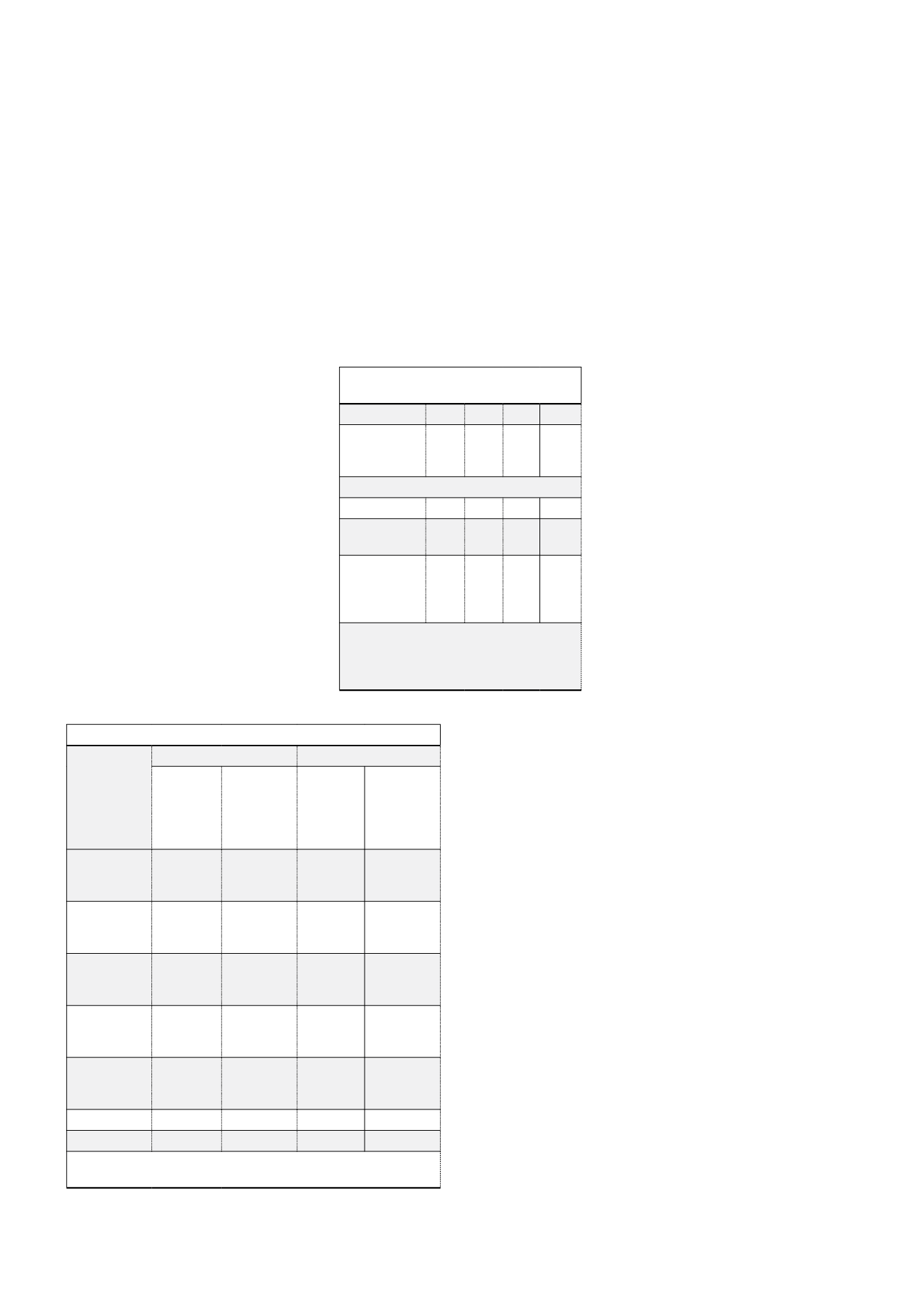

Table 3. Oil extraction and transportation

(million t)

2010 2011 2012 2013

Extracted oil,

including gas

condensate

506 512 519 522

Including:

Extracted oil

486 492 497 497

Unstable gas

condensate

19.4 20.5 21.3 24.2

Freight

transported

by oil

pipelines

492 544 423 425

Source: Transport and communications

(2014), Moscow: Rosstat, 2014 – Table

2.3; Russia’s 2014 Statistical Pocketbook.

Rosstat, Moscow – Table 14.16.

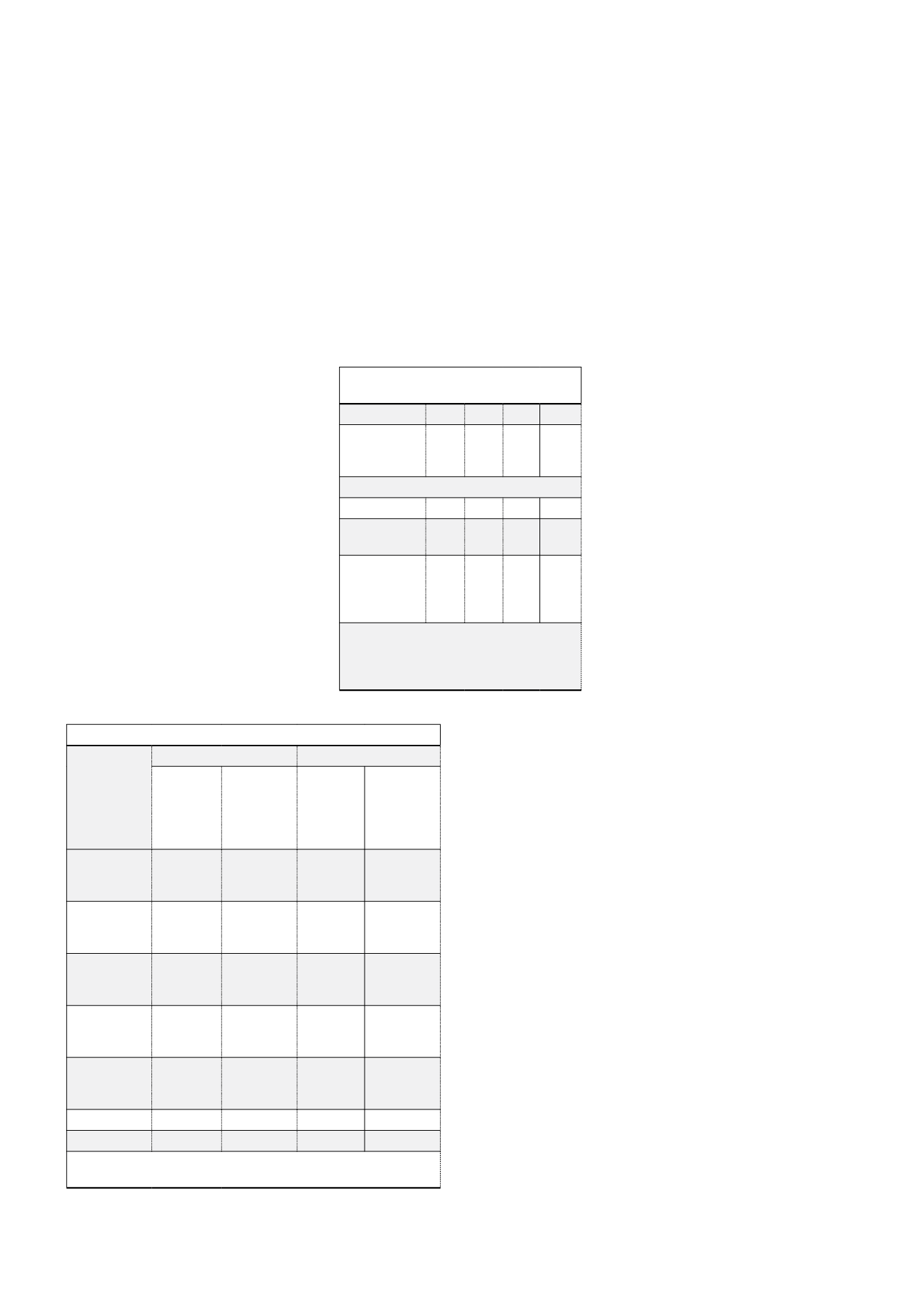

Table 4. Trunk pipeline breakdown by time in service in Russia

Time in

operation

As of 31 December 2013 As of 31 December 2014

Length

(thousand

km)

Amount

relative to

all trunk

pipelines

(%)

Length

(thousand

km)

Amount

relative to

all trunk

pipelines

(%)

Less than

10 years

(inclusive)

21.1

12.5

20.6

12.1

From 11 -

20 years

(inclusive)

20.0

11.8

20.7

12.1

From 21 -

30 years

(inclusive)

56.5

33.4

50.6

29.6

From 31 -

40 years

(inclusive)

41.7

24.7

46.6

27.3

From 41 -

50 years

(inclusive)

19.7

11.7

20.6

12.1

Over 50 years 9.9

5.9

11.6

6.8

TOTAL

168.9

100

170.7

100

Source:

annual-report-2014-en.pdf

22

World Pipelines

/

MARCH 2016