HYDROCARBON

ENGINEERING

24

Supplying more than 5000m

3

of LNG

Small and medium sized LNG (import) terminals cannot accept large

ocean going LNG vessels. They source their LNG from nearby

import terminals via short sea shipping.

Apart from some anecdotal transactions, international short

sea shipping of LNG in amounts above 5000 m

3

in Northwest

Europe started with the commissioning of the small scale

liquefaction plant in Risavika, Norway, and the small scale import

terminal in Nynashamn, Sweden, in 2011. At that moment, short sea

shipping started to be performed routinely by the 7500 m

3

Coral Methane

and later by the 15 600 m

3

Coral Energy

.

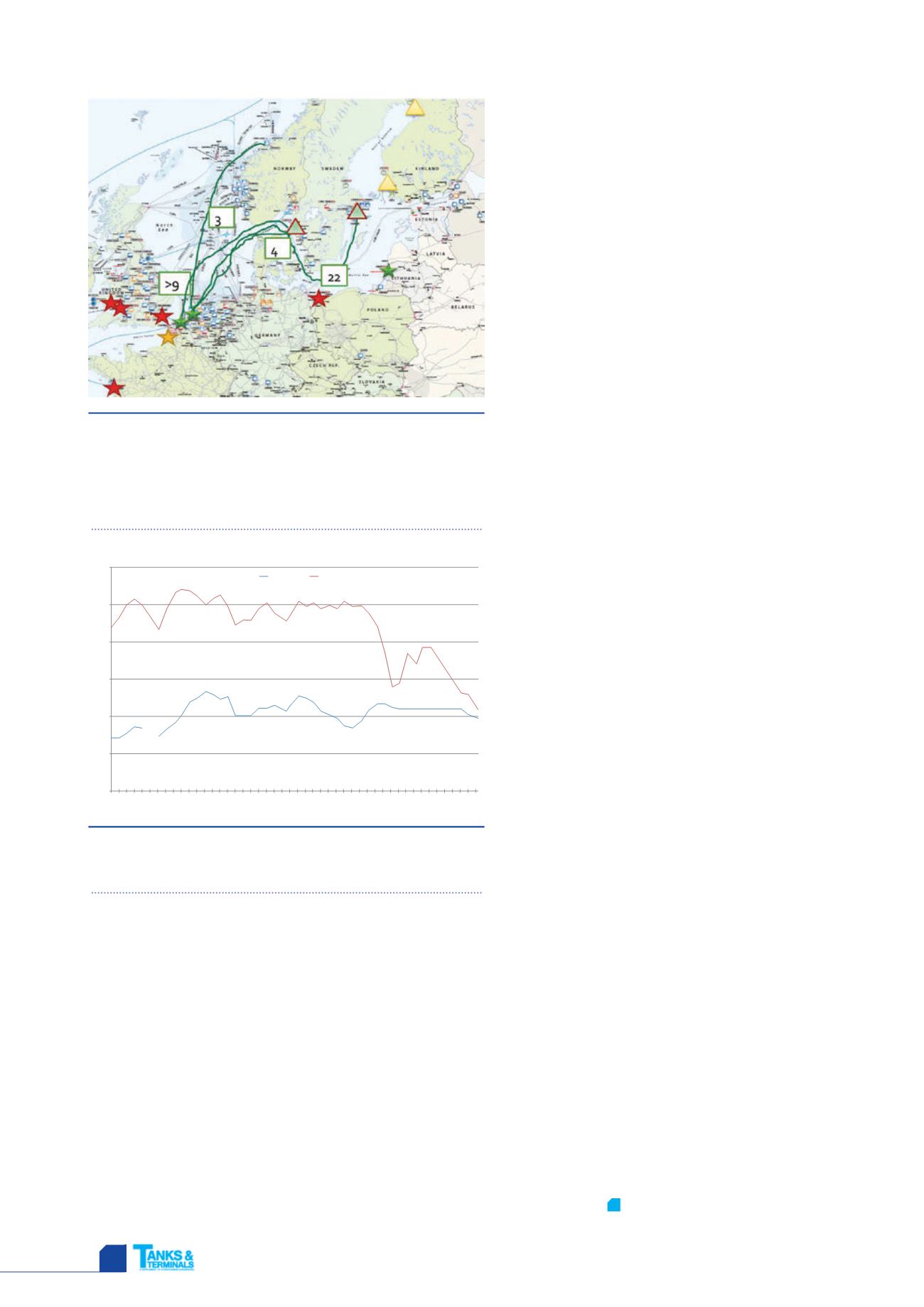

As can be seen from Figure 4, several structural short sea LNG

shipping routes have emerged. Deliveries to Nynashamn from Gate

in Rotterdam started in 2013 and were complemented in 2014 by

deliveries to Lysekil, also Sweden, which also received supply from

Risavika. In 2015, the

Coral Energy

also started reloading at

Figure 4.

Example of reach of shortsea between Northwest

Europe and Scandinavia (from 2013). The stars indicate large

scale import terminals, the triangles indicate small scale

import terminals, and the colours indicate whether small

scale reload is operational, under construction, or not yet

available. Norway is not indicated. Adapted from GLE.

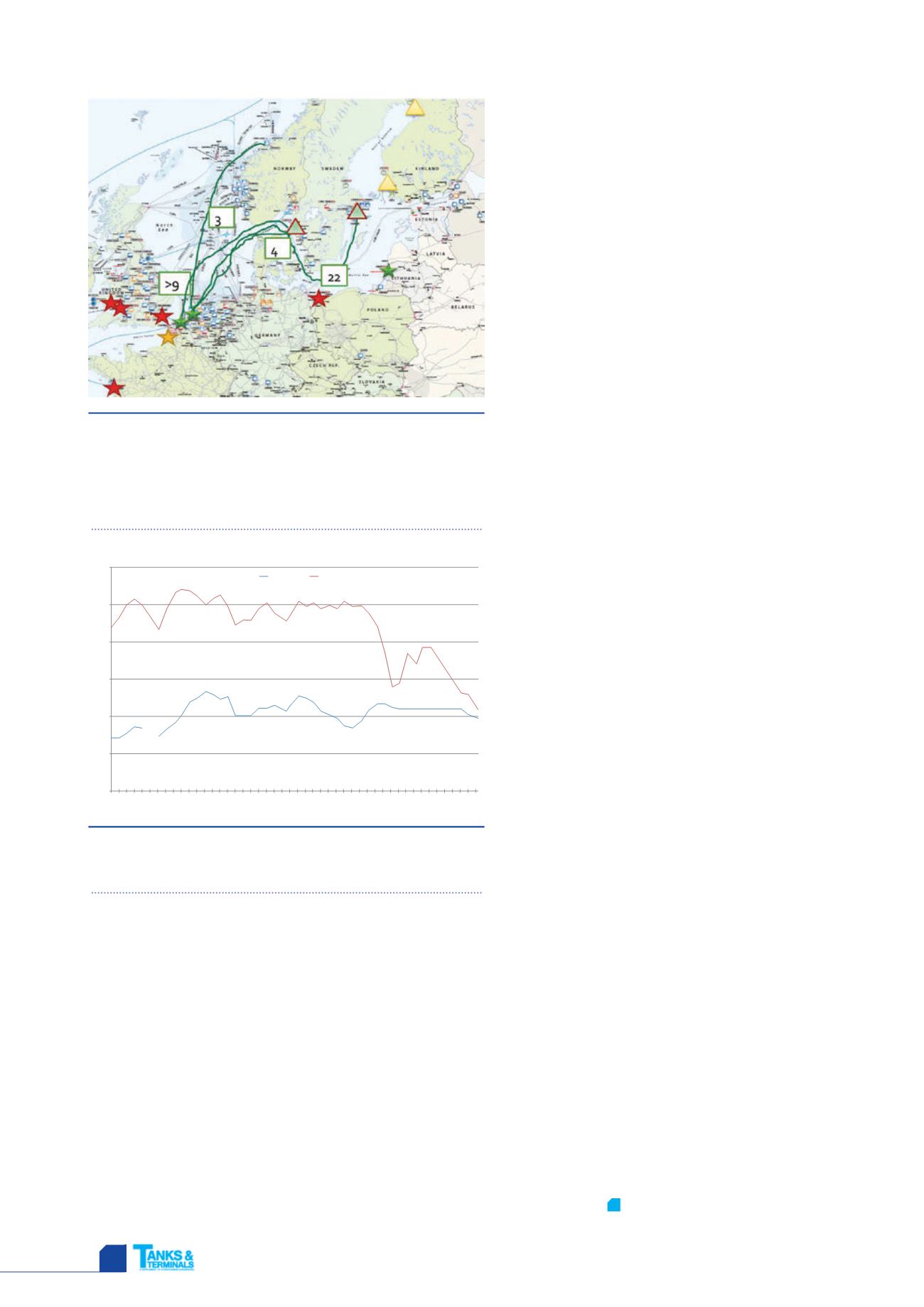

Figure 5.

Price of LNG at a truck filling station in

€/kg, compared with Dutch advice price for diesel in €/l.

Source: LNG 24.

Zeebrugge towards Lysekil, and the

Coral Methane

delivered LNG from Gate in Rotterdam to Norway.

The short sea LNG fleet, which currently comprises the

Coral Methane

, the

Coral Energy

and the

Coral Anthelia

, will

be extended in 2018 by an 18 000 m

3

vessel, also from

Antony Veder. Evergas has various multi-gas carriers in

operation, and recently decided to order additional LEG

vessels to free up some of its 27 500 m

3

multi-gas vessels for

LNG trade. Norgas, which operates multi-gas carriers in the

10 000 - 12 000 m

3

range, has also indicated its intention to

focus on LNG.

What can be observed from this is the start of a well

connected network, which should make it easier for

companies to decide on new small scale terminals. It is clear

that LNG distribution infrastructure is subject to a dynamic

environment, but polls at LNG conferences also indicate that

infrastructure is no longer considered as a main hindrance for

LNG development.

The end customer

With a favourable regulatory environment, and the

availability of LNG at any place in Northwest Europe in any

quantity, price becomes the key issue. The graph in Figure 5

compares prices of diesel and LNG at a truck filling station in

the Netherlands. It underlines the dramatic impact of the

falling oil prices on business cases. Contrary to China, LNG

fuelled trucks in Europe are still much more expensive than

diesel trucks (around

€

30 000 difference). Assuming a fuel

consumption of 25 kg LNG versus 30 l of diesel per 100 km, it

can easily be calculated that, even for 100 000 km of annual

mileage, the LNG proposal was attractive.

Although take up of LNG by trucks and vessels has been

slower than generally anticipated a couple of years ago, it is

encouraging that, even in the current challenging market

environment, parties still opt for LNG as a fuel (the order

book for LNG fuelled ships is not decreasing) based on

expectations of rising oil prices and/or the environmental

advantages (e.g., silent trucks can deliver to shops 24 hours a

day). The competitive position of LNG as a fuel should

further improve as this nascent industry continues to roll out

further infrastructure – the number of truck filling stations in

Northwest Europe is still patchy but various companies have

announced their intention to fill in the gaps.

Conclusion

The LNG infrastructure industry has shown its ability to

provide all the equipment and services, when and where

required. Bunkering vessels are on order, LNG terminals offer

truck loading services, small terminals have been built, short

sea ships are sailing, ports have bunker locations, and truck

filling stations are being rolled out. Competing with a well

established oil distribution network was never going to be

easy, and the oil price slide has made it much more difficult

for end customers to switch. However, a critical mass of

supply and demand is in place, and with every investment

announcement the distribution costs can be reduced, while

flexibility and robustness increases. The LNG distribution

chain approaches the reversed ‘chicken or the egg’ situation:

infrastructure allows demand to grow, which in turn allows

new infrastructure.

T&T

shistorie van LNGen ter vergelijkingwordt de dieselprijs* ookweergegeven.

LA) prijs isafkomstig vandewebsite vanUniitedConsumers, dezewordt dagelijks vastgesteld op basis van hetgemiddelde van de landelijkeadviesprijzen van de vijfgrootsteoliemaatschappijen.

Grafiek

G prijsDiesel

PrijzenLNG vsdiesel

g

€ / liter

inclBTW

1.439

1.465

1.499

1.515

1.499

1.469

1.433

1.489

1.533

1.541

1.537

1.523

1.499

1.517

1.526

1.495

1.445

1.459

1.458

1.489

1.505

1.477

1.456

1.471

1.509

1.495

1.505

1.489

1.498

1.489

1.509

1.495

1.497

1.477

1.441

1.373

1.279

1.289

1.369

1.341

1.385

1.385

1.263

1.259

1.218

1.000

1.100

1.200

1.300

1.400

1.500

1.600

Jan/12

Feb/12

Mar/12

Apr/12

May/12

Jun/12

Jul/12

Aug/12

Sep/12

Oct/12

Nov/12

Dec/12

Jan/13

Feb/13

Mar/13

Apr/13

May/13

Jun/13

Jul/13

Aug/13

Sep/13

Oct/13

Nov/13

Dec/13

Jan/14

Feb/14

Mar/14

Apr/14

May/14

Jun/14

Jul/14

Aug/14

Sep/14

Oct/14

Nov/14

Dec/14

Jan/15

Feb/15

Mar/15

Apr/15

May/15

Jun/15

Jul/15

Aug/15

Sep/15

Oct/15

Nov/15

Dec/15

prijs LNG

prijsDiesel