June

2016

HYDROCARBON

ENGINEERING

18

Sasol also made plans for a Sasol Four complex, but they

were shelved. This was envisioned as an 80 000 bpd CTL plant

known as Project Mafutha, to be built in the Limpopo District,

which is in the northeastern part of the country abutting

Botswana and Zimbabwe. The project fell out of favour

because of issues regarding carbon emissions and carbon

capture, and also about scale. At the time, PetroSA was

pursuing a grassroots refinery project known as

Project Mthombo, and the government believed that the

output was better suited to the future demand pattern.

In 1993, South Africa commissioned its GTL plant at

Mossel Bay. It was originally known as Mossref, then Mossgas,

and now is often named PetroSA Mossel Bay. It is located due

north of the offshore Block 9 production area that includes

the E-CE gas fields and F-A gas and condensate fields.

Feedstock arrives via pipeline. It was originally planned as a

25 000 bpd facility, but the design was expanded to

45 000 bpd during construction. Most of the output is

oriented toward synthetic fuel, with a small amount of

chemicals output also.

With the Sasol and Mossel Bay CTL and GTL plants

onstream, the output of these synthetic liquids jumped to

172 000 bpd in 1993 and hit a peak of 185 000 bpd in 1997.

Output since then has been approximately 150 - 160 000 bpd,

with a slight downturn to 140 000 bpd in 2014. In 2014,

South African liquids production included:

n

n

140 000 bpd of CTL and GTL.

n

n

3000 bpd of crude oil.

n

n

5000 bpd of natural gas liquids.

n

n

14 000 bpd of refinery processing gain.

Therefore, unconventional liquids accounted for over 86%

of South Africa’s total liquids supply in 2014. Without

expansion and feedstock, however, output has tailed off. Total

liquid supply peaked at 234 000 bpd in 2004, and it declined

to 162 000 bpd in 2014. As noted, South Africa has a number of

prospective oil and gas basins, and a number of offshore

blocks have been awarded, but the current low oil prices do

not encourage development.

Oil demand and change

The stagnation and gradual decline of liquid hydrocarbon

production has not been matched by a decline in demand.

South Africa is a net importer of oil and oil products, and the

government remains concerned about import dependency

and supply security. Figure 5 compares the trend in

South African liquids supply, as noted by EIA, with

South African demand, as published by BP. In 1981, liquid

production was a mere 4000 bpd, whereas BP reported that

demand was 270 000 bpd. Therefore, the gap between supply

and demand was roughly 266 000 bpd. This level of import

dependence was of great enough concern that it motivated

the government to launch its world scale CTL and GTL

industry. Yet demand kept growing, so that even at the peak

production years in the mid-1990s, the supply gap never got

narrower than 180 - 200 000 bpd. By the year 2002, the supply

gap was 269 000 bpd – essentially back to where it was in

1981, when the government made huge investments to reduce

import dependency. By the year 2014, the gap had widened to

445 000 bpd, leaving the government to ponder once again

about what to do to reduce import dependency.

South African oil demand has not grown at break neck

speed, but it has grown steadily. In many mature economies,

oil demand is expected to begin to decline, as it has done

already in some countries. But South Africa’s energy markets

are not considered to be quite at that point, and the economy

remains energy intensive.

Figure 6 shows the trend in demand for six key products

tracked by the South African Department of Energy, published

by the South African Petroleum Industry Association (SAPIA).

Gasoline and diesel are the key fuels, collectively accounting

for 80 - 87% of the six fuels noted in the figure. The relative

roles of gasoline and diesel have reversed, however. In 1994,

gasoline demand was 165 900 bpd (54% of the total), and

diesel demand was 881 000 bpd (29% of the total). Yet

gasoline demand grew modestly at an average rate of 0.3%/y

from 2004 - 2014. In contrast, diesel demand grew at an

average rate of 5.5%/y from 2004 - 2014. Over the decade,

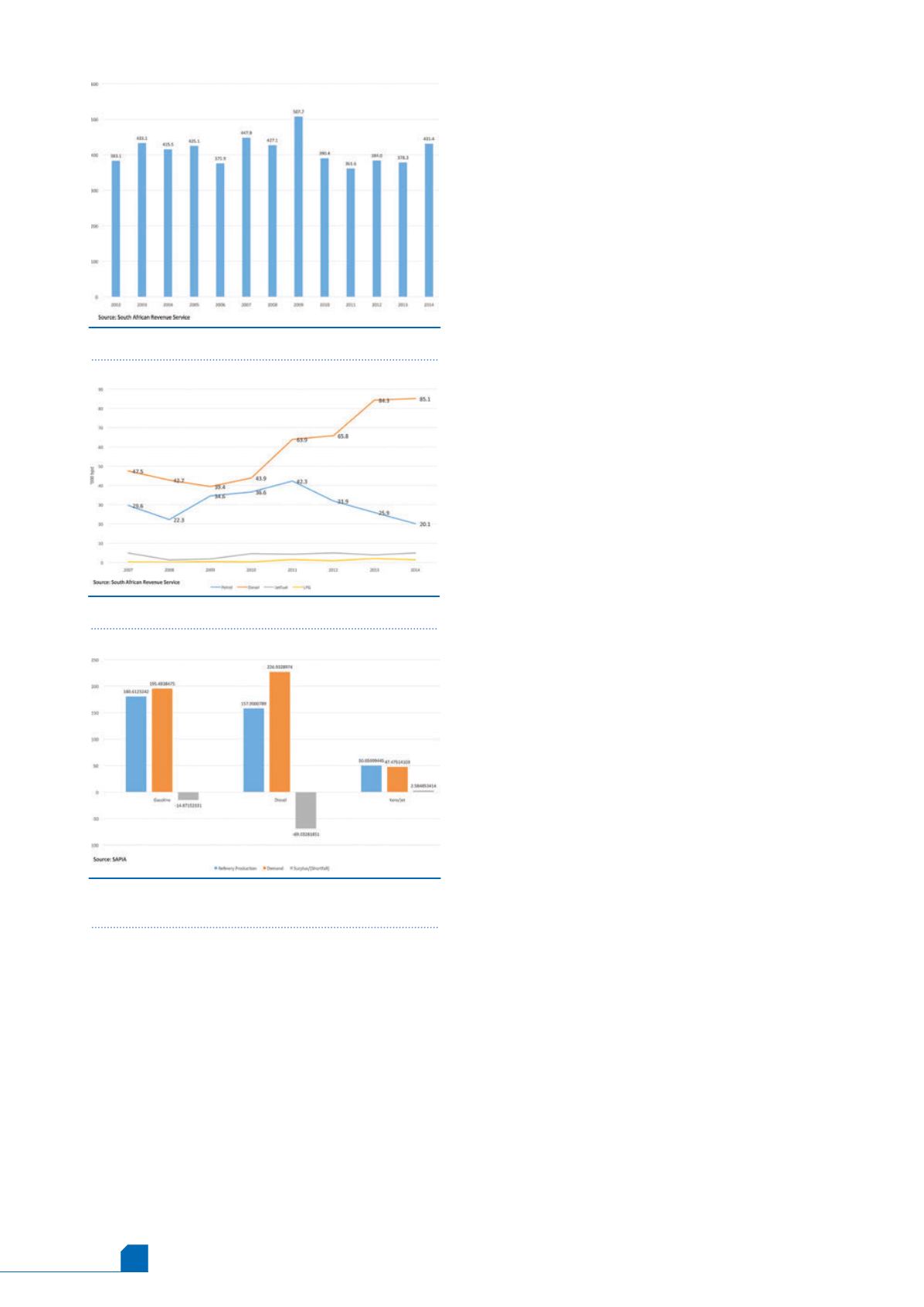

Figure 9.

South African refinery output versus

demand, three key products (2014).

Figure 8.

South African petroleum product imports.

Figure 7.

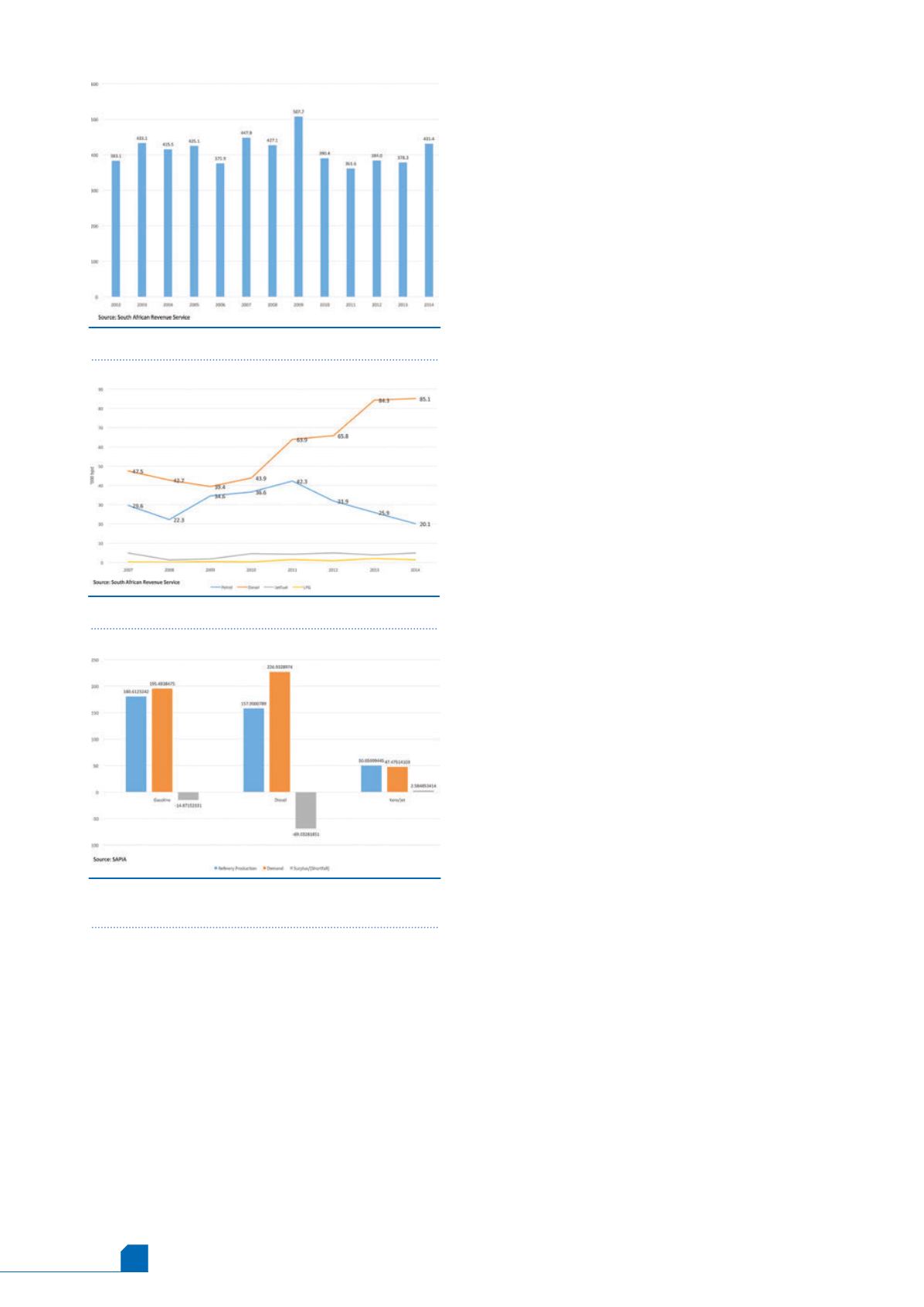

South African crude imports (000 bpd).