extend its terror into the region and beyond, most notably

into China. The US and Japan are loosely allied against China

and Russia, while India has a foot in each camp, and they are

all sworn to fight ISIS. The US – backed by its European allies

– and Russia are fighting a new Cold War, but may have to

set aside their differences to stop the greater threat posed by

ISIS. The West covets greater economic ties with China, yet

wants to check Beijing’s global rise, which has Russia’s support.

In Central Asia, Russia has roped in Kazakhstan and

Kyrgyzstan – along with Belarus and Armenia – to form the

Eurasian Economic Union (EEU), which will support China’s plan

to revive the old Silk Route under its ambitious ‘One Belt One

Route’ strategy to connect the markets of Asia, the Middle

East, North Africa and Europe.

China is deepening its reach into Central Asia with plans

for more infrastructure investments, focused particularly

on the region’s two most hydrocarbon-rich countries –

Turkmenistan and Kazakhstan – to aid its push into the Middle

East and Europe. Laggards Japan and India are making up for

lost time with the Prime Ministers of both countries leading

business and political delegations for the first time to meet

the region’s leaders in recent months. In early November,

the US despatched State Secretary John Kerry to Kyrgyzstan,

Uzbekistan, Kazakhstan, Tajikistan and Turkmenistan to push

back against growing Chinese and Russian influence, and a

rapidly expanding ISIS.

The world’s rush into Central Asia has gained urgency

in recent months amid mounting evidence of the region’s

alarming economic decline that began when oil and gas prices

started crashing in mid 2014. In a grim update in October

2015, the International Monetary Fund (IMF) warned that the

CAC’s economies are still reeling from “a wave of external

shocks” caused by falling commodity prices, sharp declines

in the value of their currencies, the contagion effects of

Russia’s recession and political fallout with the West, and

China’s slowing economy. The region’s economic problems will

accentuate threats to its political stability as rising inflation

and unemployment are adding to domestic discontent

resulting from slowing growth.

The IMF’s assessment was issued before geopolitical

threats to the region intensified in November following ISIS’s

terror attacks in Paris that sparked an increase in French and

Russian bombing raids in Syria, and Turkey’s shoot-down of a

Russian military jet plane. US, Russian and Chinese intelligence

have warned of ISIS’s escalating activities. The conflicts in

Syria and Iraq are threatening to spill over into the CAC

region.

Region’s oil importers not benefitting from low

prices, says IMF

The IMF stated that the CAC region will continue to reel from

the impact of weak oil prices through 2016, with little hope of

their economies recovering to the levels before the collapse

of the energy markets in mid 2014.

“A wave of external shocks – primarily falling commodity

prices, spillovers from Russia, and movements in major

exchange rates – continue to weaken growth prospects and

heighten financial vulnerabilities in the region,” the IMF said

in its External Shocks Dim Growth Prospects for Caucasus,

Central Asia survey.

Growth will barely recover in 2016 despite improving trade

with Russia and the Eurozone, as well as the short term impact

of the wave of currency depreciations recently undertaken by

the region’s beleaguered governments.

Despite weak energy prices, the CAC’s four oil importers

will suffer more as they remain largely dependent on worker

remittances and trade with its four oil exporters and Russia,

said the IMF. Armenia, Georgia, the Kyrgyzstan and Tajikistan

will feel the dual impact of Russia’s recession and the rouble’s

collapse.

The IMF expects the economies of Georgia and Kyrgyzstan

to each grow by 2% in 2015, down sharply from 4.8% and 3.6%

respectively in 2014. Armenia’s economic growth will fall to

2.5% from 2014’s 3.4%, while Tajikistan’s will plunge by more

than half from 6.7% to 3%.

Despite the weak outlook on energy prices, Azerbaijan,

Kazakhstan, Turkmenistan and Uzbekistan can still rely on

revenue from oil and gas exports, and their hoard of past

savings.

“The region’s oil exporters have been able to draw on

savings built up when oil prices were higher. In the short term,

this has helped them tackle their immediate fiscal challenges,

but more needs to be done,” said the IMF. In the medium

term, the fund recommends that they consolidate their fiscal

position, implement structural reforms and intensify efforts to

diversify away from oil.

The IMF expects the region’s star economy, Turkmenistan,

to maintain its turbo-charged performance by growing 8.5%

in 2015 and 8.9% in 2016, down slightly from 2014’s 10.3%.

Uzbekistan’s economy will also put in a world-beating

performance to expand by 6.8% in 2015 and 7% in 2016, to

follow on 2014’s 8.1%.

The region’s largest economy, Kazakhstan, will be its worst

performer with growth expected to collapse to just 1.5% in

2015 and 2.4% in 2016. Azerbaijan’s economy will expand by 4%

in 2015, making it the only one in the region to show year-on-

year improvement compared with 2.8% in 2014.

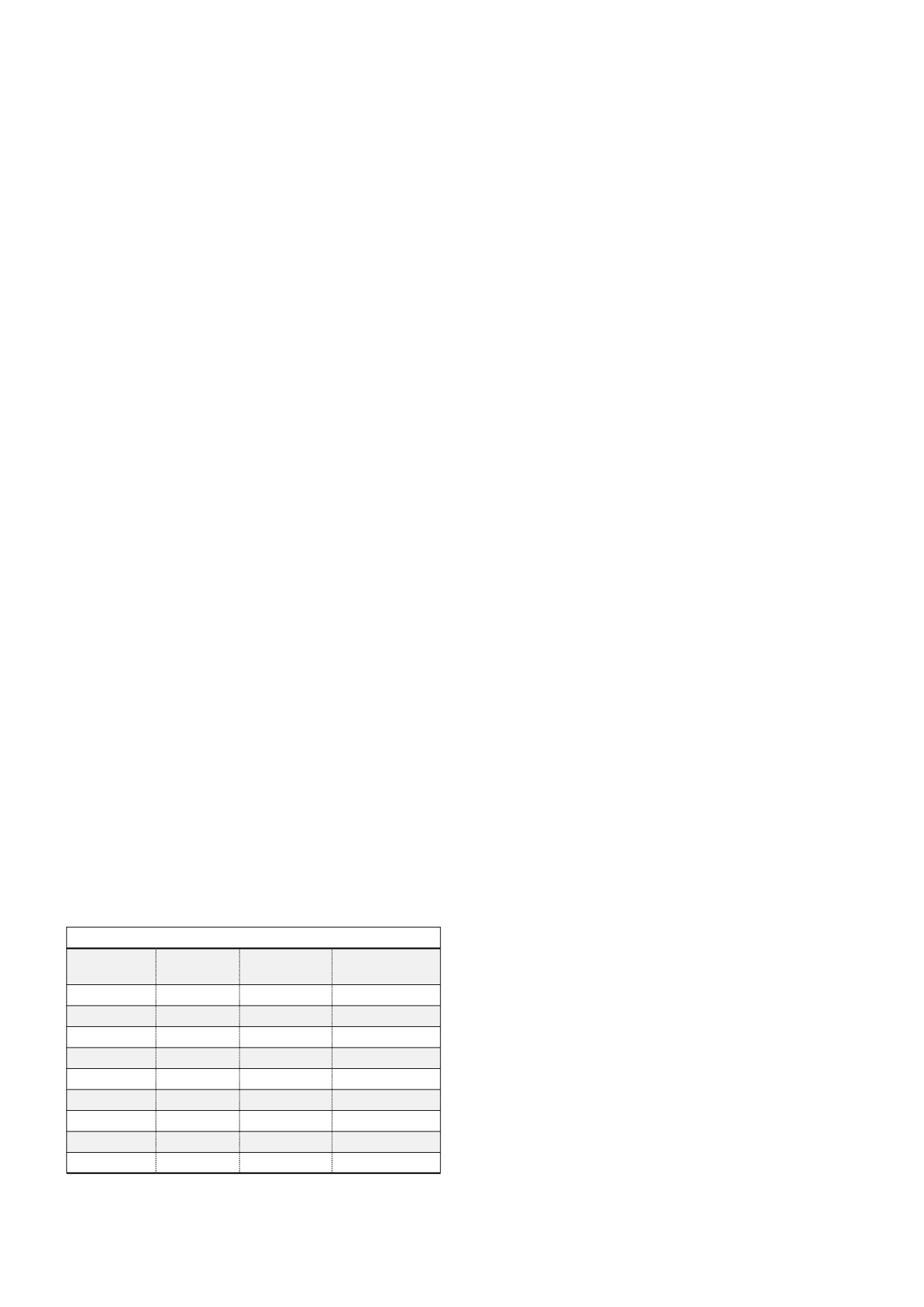

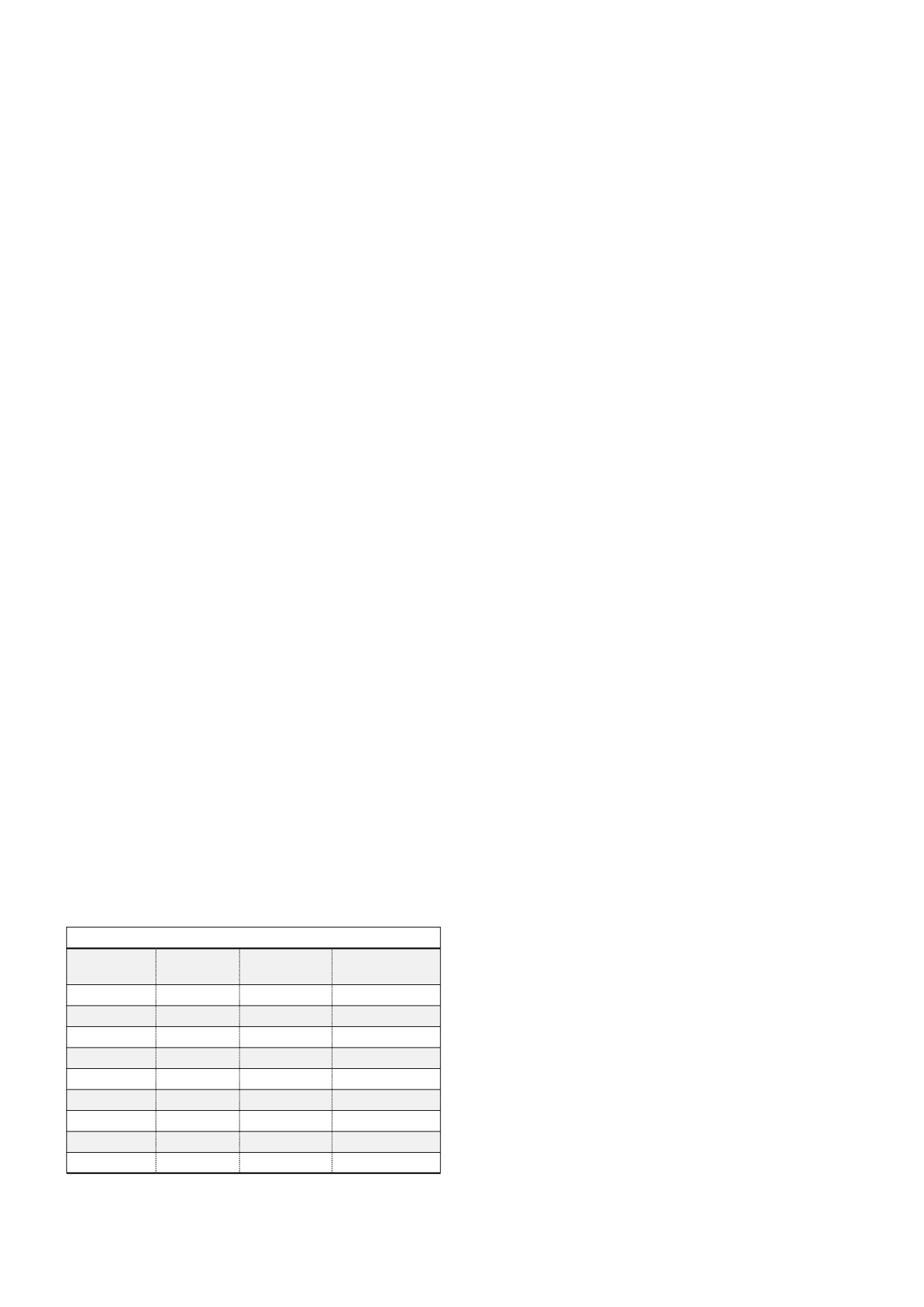

Table 1. CAC population and GDP in 2014. Source: World Bank

Population

(million)

GDP

(US$ billion)

Average GDP US$

per capita

Armenia

3.0

10.9

3627

Azerbaijan

9.5

75.2

7916

Georgia

4.5

16.5

3670

Kazakhstan 17.2

212.2

12 337

Kyrgyzstan 5.8

7.4

1275

Tajikistan

8.4

9.2

1095

Turkmenistan 5.3

47.9

9038

Uzbekistan 30.7

62.6

2039

TOTAL

84.4

441.9

5236

14

World Pipelines

/

FEBRUARY 2016